20 Social Media Holidays to Celebrate This May

By Yasmin PierreApr 10

Unlock the secrets to staying ahead in the ever-evolving world of social media marketing.

Published March 23rd 2015

We are big believers in the benefits of content marketing at Brandwatch. Since the very beginning we’ve worked hard to create content that offers value to our audience.

Today, our content marketing suite includes blog posts, industry reports, how to guides, videos, webinars, data visualizations, and attending and hosting global events (yep, events count as content marketing too).

We’ve found that using our own social listening tool has been a huge benefit to our content marketing, and many of our clients have too.

Rather than keeping these secrets guarded, we’ve decided to let you in on how social listening can improve your content marketing.

Before you start creating content you should have a good idea of what who you are trying to target.

Let’s say you work at a brand who specialize in running apparel. You might have a rough idea of your buyer demographic based on your sales data, but this might not correlate with the type of people who are actively talking about running online.

Using Brandwatch Analytics we can set-up a search Query to find online conversations relating to running. The Demographics Insights dashboard allows us to find out and compare:

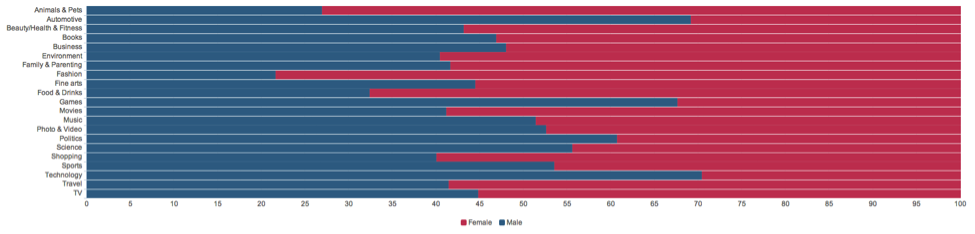

The chart above shows us how the interests of people talking about running vary between genders. Women are more likely to be interested in fashion, while men are more likely to show an interest in technology.

The chart above shows us how the interests of people talking about running vary between genders. Women are more likely to be interested in fashion, while men are more likely to show an interest in technology.

Using this data we might conclude that males would be more receptive to content about running gadgets.

Demographic Insights help us create personas that describe the type of people we want to target. Personas help us keep our content focused on the users’ needs and interests.

Knowing how the conversation changes based on where it’s happening is an important part of creating a multi-channel content strategy. To adapt an old adage: if content is king, then context is queen.

Your content strategy should be adapted to suit the demographics and conversations of the communities you are targeting.

Discussion on running forums might be very different to Twitter conversations about running.

Discussion on running forums might be very different to Twitter conversations about running.

Knowing the nuances between different communities will help you create content that resonates.

We all know that social media trends and conversations can shift on an hourly basis. Knowing what is influencing conversations is key to creating a successful content strategy.

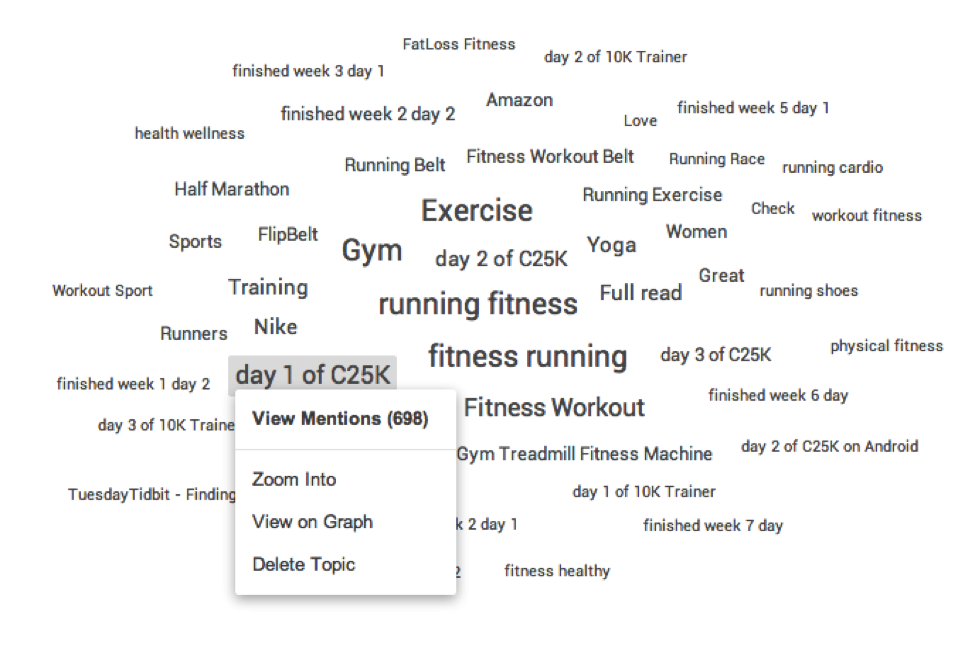

Social listening allows us to get an overview of the common topics behind the conversations.

Here we can see that a large number of runners are talking about C25K, a running programme that helps beginners go from being couch potatoes to 5K distance runners in 8 weeks.

Here we can see that a large number of runners are talking about C25K, a running programme that helps beginners go from being couch potatoes to 5K distance runners in 8 weeks.

We could now create piece of content offering advice on suitable trainers for the C25K challenge.

Social listening can also helps us understand what types of content get shared the most. Using Brandwatch we can start to track what are the most popular pieces of content your audience are sharing.

You might notice that videos have a much higher engagement rate than blog posts. Or that infographics are shared more frequently on Twitter.

Knowing what has worked well in the past means you can start to create content that has a better chance of resonating with your audience.

We regularly use our own platform to find interesting stories within social data.

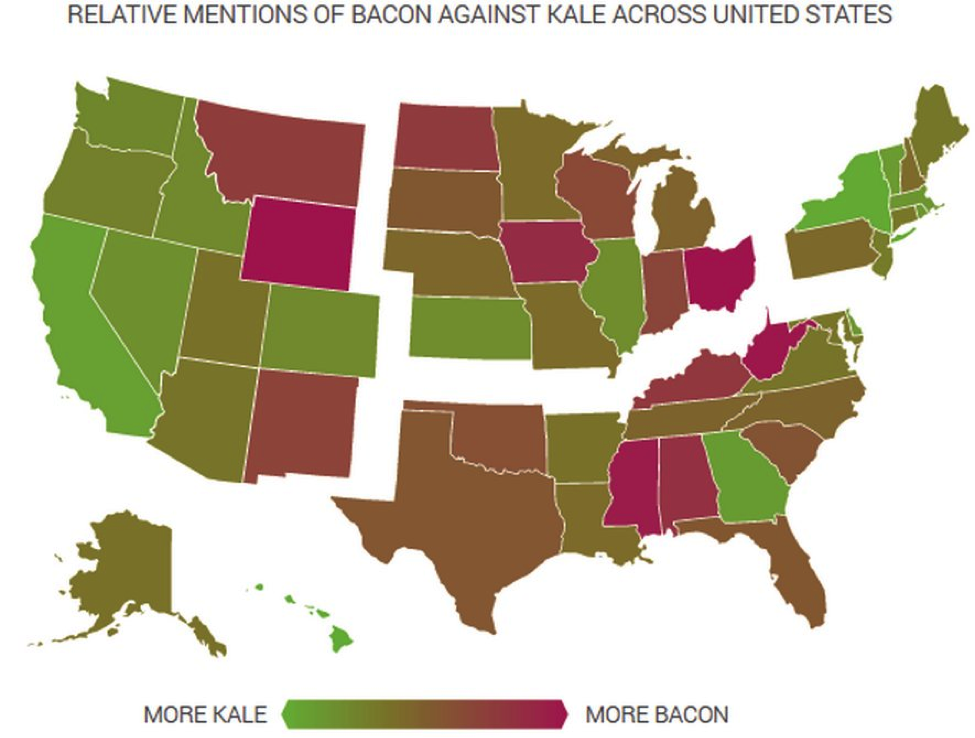

For example, for a recent report we compared conversations around bacon and kale. By plotting the mentions by location, we were able to see which states were more likely to be chatting about kale and which were all about the bacon.

This insight sparked further discussion, such as ‘does bacon and kale conversation correlate with political orientation?’, and was covered by Bloomberg, Business Insider and Fox News.

This insight sparked further discussion, such as ‘does bacon and kale conversation correlate with political orientation?’, and was covered by Bloomberg, Business Insider and Fox News.

Staying relevant in the shifting social media landscape is a tricky prospect for brands. Fortunately, social listening enables us to track reactions to current events and find breaking news quicker than ever before.

These days countless brands are creating microcontent in reaction into hot topics – a practise known as ‘real-time marketing’. Perhaps the most famous example of real-time marketing is Oreo’s show-stealing ‘Dunk in the Dark’ Superbowl tweet.

Power out? No problem. pic.twitter.com/dnQ7pOgC

— Oreo Cookie (@Oreo) February 4, 2013

The Oreo tweet wasn’t just a shot in the dark (excuse the pun); it was part of larger strategy to ensure that their brand connects with a new generation of consumers.

There’s no point spending time creating content if nobody ends up seeing it.

Promoting through your owned channels should be the bare minimum. If you want to improve your chances of success you might consider reaching out to influencers within your niche.

Brandwatch Analytics makes it easier to find relevant influencers who can help amplify your content marketing, as it comes packed with metrics and filters that help you identify the right influencer.

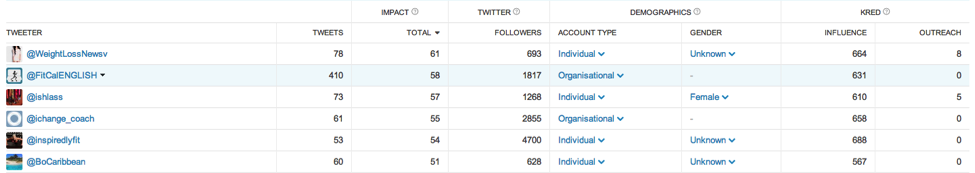

Here we can a see list of the most influential Tweeters who are talking about running.

We can compare influencers to see:

We can compare influencers to see:

– Who is the most active

– Which have the widest reach and most followers

– Which have the most impact on their audience (impact score)

– How often people engage with them (Kred)

– How active they are in enaging with others (Outreach)

We can also filter by:

– Number of followers

– Organisation or individual

– Gender

– Location

We recently published an entire guide dedicated to influencer marketing. It’s free to download.

As with all aspects of digital marketing, it’s important to measure success. Of course, campaign success is dependant on what your goal is.

Tracking your ‘owned’ social channels is quick and easy with Brandwatch’s Channels feature.

Where social listening comes into its own is the ability to track ‘earned’ mentions across the web. Rather than covering the inner workings of measuring campaign success, we suggest you check out our campaign measurement guide.

Find out how Brandwatch can help you reach your content marketing goals with a demo of our platform.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

Consumer Research gives you access to deep consumer insights from 100 million online sources and over 1.4 trillion posts.

Existing customer?Log in to access your existing Falcon products and data via the login menu on the top right of the page.New customer?You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution.Want to access your Paladin account?Use the login menu at the top right corner.